Understanding Redeployment in EB-5 Investments

Per current USCIS policy, every EB-5 investor is required to maintain their funds “at-risk” through the completion of their two-year conditional residence period (or sustainment period). Redeployment is necessary to maintain the funds “at risk” if an EB-5 investment is repaid prior to an investor completing their respective sustainment period.

Our Strategy

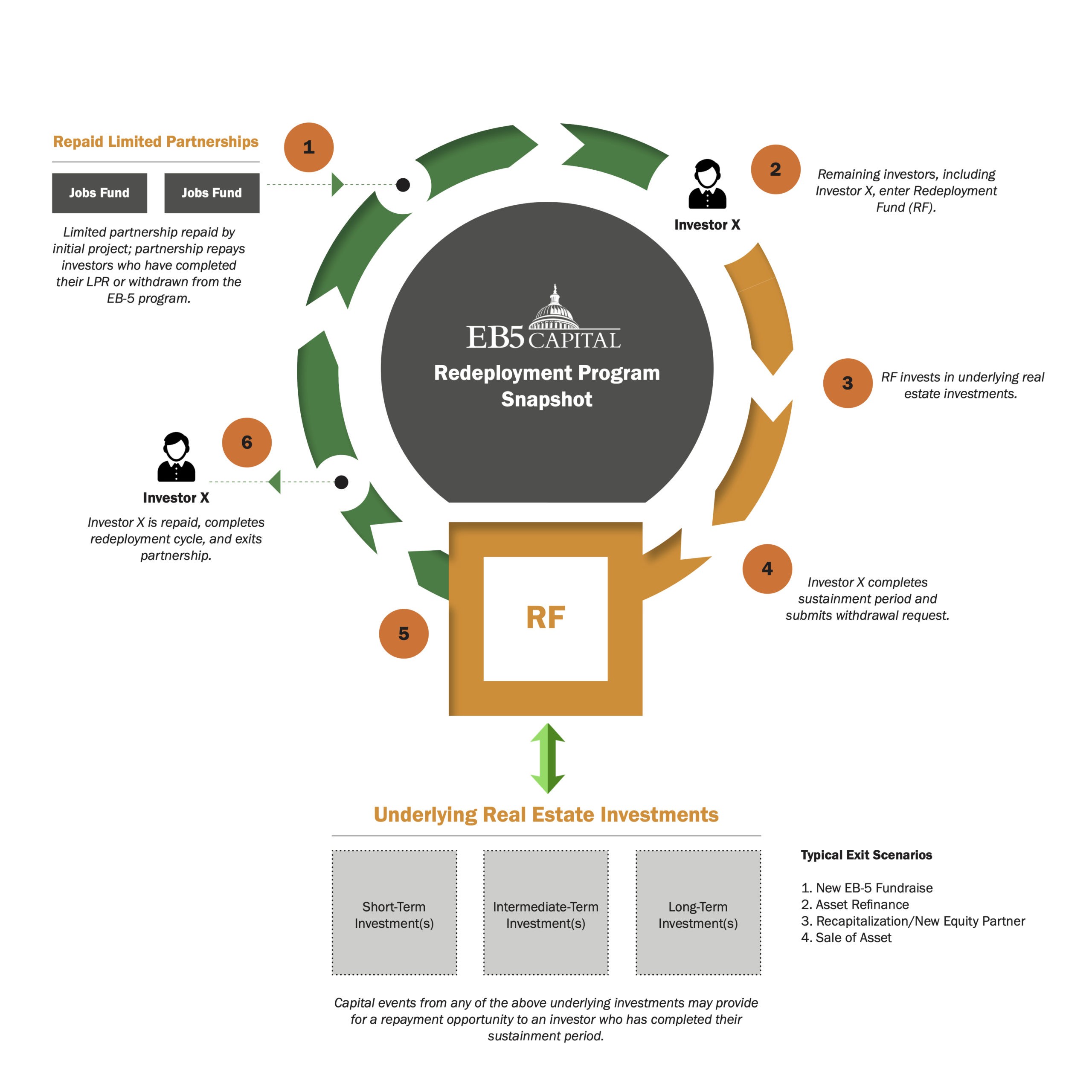

EB5 Capital’s redeployment strategy centers around reinvesting the capital contribution of investors who have not completed their sustainment period into a fund – referred to as a Redeployment Fund – that finances commercial real estate (CRE) projects.

Redeployment Funds identify and invest in CRE projects with varying terms based on the projected repayment eligibility of the EB-5 investors within each fund.

A Simple Example

Investors in a Jobs Fund who are not eligible to have their investment repaid see their funds reinvested into a Redeployment Fund. The Redeployment Fund (RF) then invests in a variety of CRE assets to maintain the investment’s at-risk status.

The graphic below demonstrates a visual representation of how our redeployment program works.

Understanding the Value of Targeted Liquidity

EB5 Capital’s redeployment fund managers strategically seek to achieve “targeted liquidity” by identifying the right combination of underlying assets to include in a redeployment fund to provide ample fund exit opportunities for those invested in the fund.

For Example: Suppose RF is comprised of 30 investors – 10 of which are projected to complete their sustainment period within one year, and 20 of which are projected to complete their sustainment period in 5 years. RF will seek to make an underlying investment in two projects – Project A, a $5M investment with a term close to one year; and Project B, a $10M investment with a term of 5 years.

Frequently Asked Questions and Answers (FAQs)

As of Q3 2022, nine of our partnerships have been redeployed.

As of Q3 2022, 69 of our investors have been successfully repaid through redeployment.

EB5 Capital’s redeployment fund managers strategically seek to achieve what we call “targeted liquidity” by identifying the right combination of underlying assets in each Redeployment Fund to provide ample exit opportunities for those invested.

Some Regional Centers emphasize offering investors the choice of “Investment A” or “Investment B” when entering the redeployment phase, limiting the ultimate repayment of investors to a single asset. EB5 Capital’s “targeted liquidity” strategy allows each individual investor diversified investment risk as well as multiple exit opportunities based upon their sustainment period completion date.

We recognize your EB-5 investment is a precious asset. Making sure your capital is invested in sound CRE investments is a job we take very seriously.

EB5 Capital’s redeployment fund managers strategically seek to achieve “targeted liquidity” by identifying the right combination of underlying assets to include in a redeployment fund to provide ample fund exit opportunities for those invested in the fund.

Investments held inside of a Redeployment Fund will vary over time. The goal of maintaining requisite opportunities for capital events to repay investors who are eligible for repayment will be at the forefront in guiding fund managers’ pursuit of sound redeployment investments.

Redeployment and the length of one’s redeployment are dependent on the investor’s individual sustainment period. After completing one’s sustainment period, a redeployed investor will be given the chance to be repaid and exit the fund at the next available capital event inside of their Redeployment Fund. This could take anywhere from several months to several years.

After completing one’s sustainment period, a redeployed investor will be given the chance to be repaid and exit the fund at the next available capital event inside of their Redeployment Fund.

An investor is eligible to submit a Withdrawal Request Form 90 days prior to the end of their two-year conditional residence period without jeopardizing their EB-5 immigration process. The investor will then receive a distribution upon the first capital event to occur after such date. As there is no guarantee of a return of funds at any particular time, the time of a return of funds will vary. However, we aim to provide repayment within a year of becoming eligible and have previously repaid eligible investors on a much shorter timeline.

Redeployment and the length of one’s redeployment period is completely dependent on their individual sustainment period. After completing one’s sustainment period, a redeployed investor will be given the chance to be repaid and exit the fund at the next available capital event inside of their Redeployment Fund. This could take anywhere from several months to several years.

An investor who is ineligible for repayment may see their money enter and exit several projects while in redeployment. The number of projects one’s money flows into and out of is dependent on the terms of the underlying Redeployment Fund investments, and their specific required sustainment period.

Investors will receive an email update each time a new member joins their Redeployment Fund or their Redeployment Fund acquires a new investment. EB5 Capital will provide brief overviews of new assets as they come into our portfolio.

We have selected redeployment into commercial real estate assets, which are similar to the initial investment. Thus, the risks upon redeployment are similar to those that were accepted by the investor prior to selecting their initial project.